Table of Content

If you live in an area at high risk for floods, flood insurance may be required by your lender. We can help you with a jewelry insurance policy to cover your valuable collection. With just a few clicks you can look up the GEICO Insurance Agency partner your home insurance policy is with to find policy service options and contact information. Insurance policy is with to find policy service options and contact information. For all other policies, log in to your current Homeowners, Renters, or Condo policy to review your policy and contact a customer service agent to discuss your jewelry insurance options. With just a few clicks you can access the GEICO Insurance Agency partner your boat insurance policy is with to find your policy service options and contact information.

For instance, the average price of homeowner’s insurance is the highest in Oklahoma at $4,445 while people in Hawaii pay the least, at $499. If you’re buying a new home, purchase a home insurance policy before closing. That way, your valuable possession will be protected the moment you sign on the dotted line. Homeowners policies are customizable, enabling you to increase coverage for your home's structure or your personal belongings. As licensed insurance agents, we do this by taking a more informal approach to how we write and talk about insurance so that the everyday person can be empowered to grab their future by the horns.

Compare Your Homeowners Insurance Options

Few standard homeowners insurance policies cover dwelling or personal property damages caused by earthquakes. However, following a quake, earthquake insurance can help offset the cost of repairing or rebuilding your home, replacing damaged personal property, and temporary housing. Homeowners living in areas prone to earthquakes need earthquake insurance. Homeowners insurance policies don’t come in one-size-fits-all packages.

Maybe your lender isn’t considering your upgrades, and thus, you may require more insurance. Details that impact rebuilding costs include the style of your house, the type of exterior, the number of rooms, special features like arched windows, and custom builds. Like liability, medical payments are made when someone is injured on your property. The limits for this coverage are lower and meant to settle small claims. This insurance will come in handy if someone were to cut themselves or have minor fall damage.

Other structures

States with frequent hurricanes, hailstorms, tornadoes and earthquakes tend to have higher home insurance rates. To get the best rates for your situation, shop around with at least three insurance companies. By comparing rates from multiple insurers, you can make sure you’re getting the best possible coverage at the lowest price. Unlike with physical objects like a refrigerator or a car, it can be difficult to pinpoint the cost of homeowners insurance.

Home insurance costs don’t just depend on what state or city you live in — rates are calculated all the way down to your house’s ZIP code. If you live in a neighborhood that experiences frequent home break-ins or wildfires, you’ll likely see higher home insurance premiums. The least expensive ZIP code for homeowners insurance is in Honolulu, Hawaii, at $579 a year on average.

Recommended Personal Property Coverage Amounts

Homeowners policies cover losses caused by certain types of perils, such as fire, theft, or windstorms. While some policy forms cover perils named in the terms of the policy, HO-3 policies cover all perils except those specifically excluded. Typical HO-3 exclusions include losses caused by earthquakes or floods. Another common policy is guaranteed or extended replacement cost coverage, which goes beyond restoring your home to its original condition.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Well, since these numbers are based on average premiums for different houses and locations across the USA, it’s hard to tell. Contact your insurance agent right away if you need help in calculating your home insurance needs or are having trouble with this process.

How can you reduce the cost of your homeowners insurance?

Home insurance costs an average of $126 per month in the United States, but prices vary significantly by state. The average cost of homeowners insurance is $126 per month, or $1,516 per year across the U.S. Rates vary by $185 per month based on where you live and the cost to rebuild your home. You can check rates across the top home insurance companies based on the type of insurance coverage you need.

Personal property protection ensures you receive the necessary compensation to replace or repair those items. While you have plenty of options to choose from, the right policy protects at a reasonable price. Get peace of mind knowing you’ve protected it with homeowner’s insurance. The most popular type of homeowners policy form is the Special Form, commonly called HO-3.

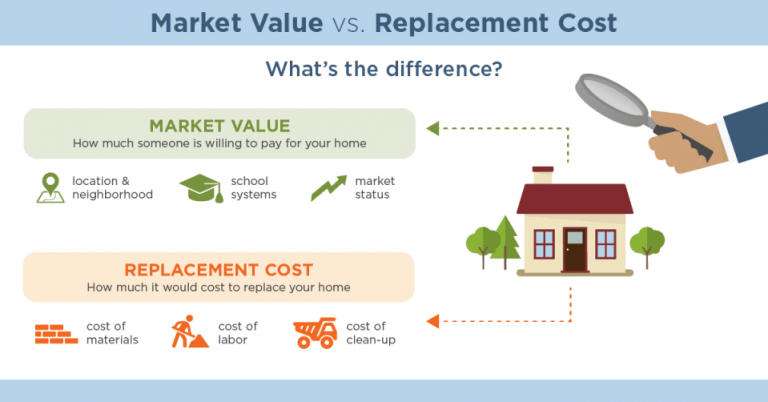

Replacement cost coverage is a worthwhile investment for homes of any price. The policy, also known as standard replacement cost, provides compensation up to your dwelling limit. Premium costs are important to most homeowners, so get quotes from several insurance companies. Also compare each provider's discounts, which can sometimes substantially reduce your rate.

It's important to read your insurance policies closely and consider what each plan is offering—and whether their coverage justifies higher rates. Areas with regularly-occurring natural disasters will have higher premium rates to offset the risk of property damage. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website.

Whereas – Rosenberg, Texas – is the most expensive ZIP code for home insurance. Its average annual rate is $6,638 per year, over $6,000 more expensive than the least expensive ZIP code. Oklahoma remains the most expensive state for homeowners insurance in the United States for another year. Its average annual rate is 61% higher than the national average home insurance cost. Once you figure out how much homeowners’ insurance you need, it’s time to find the price you want. Shopping around is easier than ever with Gabi as you can compare homeowners insurance rates from a wide variety of insurers online, all in one place.

We maintain strict editorial independence from insurance companies to maintain our editorial integrity, so our recommendations are unbiased and are based on a comprehensive list of criteria. Average homeowners insurance cost Homeowners Insurance Insurance More... You can expect to pay more for replacement cost coverage, but it may be worth it to protect yourself against coverage gaps caused by depreciation. The average homeowners insurance premium in the United States is $1,272 a year. Your mortgage company has a vested interest in your property, so they will have strict guidelines for the minimum insurance you can carry. In general, lenders want you to carry enough to rebuild your home to protect their investment.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. These types of coverage are often also set in proportion to your dwelling coverage limit.

No comments:

Post a Comment